Our 3 principles of investment give you an inside look into the basic ideologies on which our proprietary rules-based trading system operates. Follow the hedgehog into our core beliefs.

Investment Principle #1: Be Invested – Invest with the Future in Mind

Investors often attempt to time the market perfectly. The truth financial advisors and analysts don’t want you to know? No one knows when the top and bottom of every market cycle will be. Because of this, investors typically miss the optimal entry point for their investment as they end up waiting for a “better time”. But don’t be discouraged! Simply because now isn’t the best time to invest doesn’t mean it’s a bad time to invest. What we don’t want is to develop FOMO, or fear of missing out. This is where an investor sees everyone else making money and makes an investment purchase in fear of being left out. Hedgehog’s models and signals are governed by rules-based trading systems, relieving investor emotion from the investment process. One of our core principles of investing beliefs is to get in the market now. If you are thinking about investing, there is no time like the present. Our Market Risk Index can help you better understand how market timing works.

Investment Principle #2: Be Disciplined – Discipline Yourself and Play the Waiting Game

Warren Buffet said it best: “We don’t have to be smarter than the rest. We have to be more disciplined than the rest.” As a core principle of investment at Hedgehog Investment Research, discipline means two things:

- Be in the market as often as possible.

- Don’t let emotions dictate your investment actions.

So how can investors retain confidence in their investments while adjusting as seldom as possible?

Patience is a key principle of investment. Exhibit B displays the average Compounded Annual Growth Rate (CAGR) from cycle to cycle using two different strategies. If an investor is continuously one month late getting in and out of the market after the bottom and top of each cycle they will average 15.1% returns as opposed to 14.5% if they are to be continuously one month early. This Late strategy outperforms the Early strategy for every time frame except if the investor is continuously 12 months late. This principle of investment helps to illustrate the point that we must be steadfast in our investment approach. Waiting for the market to show its cards before changing investment direction is far more advantageous than attempting to time the market. Want to know when to adjust your portfolio? Check out our Stock Bond Rotation Model.

Investment Principle #3: Avoid Large Losses – Learning How to Time the Market

Since the 1930’s the S&P 500 has spent about 80% of its life in a bull market and the other 20% in a bear market. Although we spend a majority of our lives in an expanding economy, investors should concentrate more on avoiding large drawdowns in their portfolios and less with maximizing their returns in times of prospering. So how do we go about this while remaining disciplined in our investments? Let’s take a look.

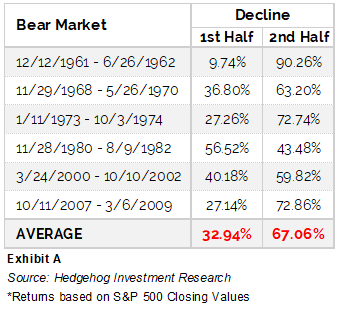

Exhibit A lists every bear market since the 1960s under the “Bear Market” column. The other two columns show what percent of the overall decline occurred in the first and second half of each bear market. On average, over 66% of the destructive nature of these bear markets occur in the second half of their life-cycle. Once again, instilling discipline and patience in one’s investment approach is far superior to subjecting themselves to the emotional investment whirlwinds that come and go. Want to know when to sidestep periods of large volatility? Check out our Equity Warning Signal.