Stock Bond Rotation Model

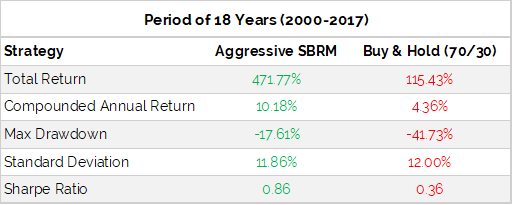

The Stock Bond Rotation Model (or “SBRM”) is the staple of Hedgehog Investment Research. The SBRM was built for the average investor looking to minimize effort, trading and account fees and maximize risk adjusted returns. This investment portfolio model updates on a weekly basis providing you with the recommended allocation to either stocks, bonds or both depending on your selected level of risk.

Market Risk Index

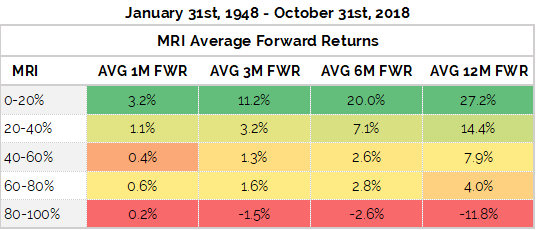

The Market Risk Index (or “MRI”) is your crystal ball into the overall risk of domestic stocks. Our index compiles various data points from the broad economy and estimates the current level of risk relative to all other data points since 1948. Use the MRI to know when things might be too risky to start your buying spree.

Equity Warning Signal

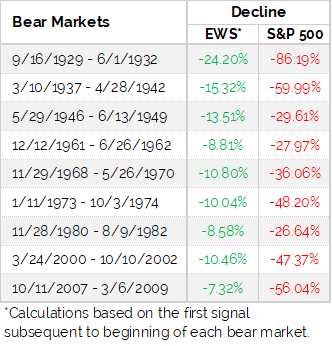

The Equity Warning Signal (EWS) is a selective trading strategy for investors to apply alongside their personalized SBRM selection. The EWS was built for investors with shorter time horizons for their money and feel their primary concern is loss of capital. This investment portfolio model lets you know anytime our system produces a signal, so you can feel secure about your investments.

Sign up for free access to our models!

The most straightforward investment guidance you’ll ever receive. That’s Hedgehog.