How Do I Start Investing? – Part 1: Investment Account Types

If you are new to investing, you’ll need to know what type of account to open, who to hold your account with, what to invest in and how to decide on your investments. This article is the first part of a two-part series that aims to answer what investment account types are available and where to invest your money.

PART 1: What type of investment account do I open and what brokerage firm do I choose?

A few different types of accounts exist. At its core, investment options include either retirement or non-retirement accounts. Depending on your financial goals, either will help you achieve long-term or short-term gain.

Choosing Between Retirement and Non-Retirement Investment Account Types

When opening an investment account you can choose between a retirement account or a non-retirement accounts. Typically, you cannot spend money out of a retirement account until you are 59 ½ years old. However, there are exceptions to this rule. Two of the most common types of retirement accounts are the IRA account and the 401k account. There are also 403b and 457 accounts, as well as others, but those are often used by public education organizations and governmental employers in the United States. For now, let’s keep it basic.

IRA vs. 401k Retirement Accounts

The primary difference between an IRA and a 401k is that a 401k must be established by an employer. Employers have no tie and little involvement to IRA account types. Employers who offer a 401k may also offer a matching incentive. This means that they will contribute money into your plan based on a percentage of your total contribution. If you are a full-time employee and your company offers a 401k plan, it would be wise to participate in the program and allocate your assets among different investment options. If your company does not offer a 401k plan and you would like to contribute towards your retirement, think about opening an IRA account.

Taxation on Retirement Accounts

Contributing to a 401k or IRA gives you a tax deduction. Once you are of age to withdraw your funds they are taxed at your highest marginal tax bracket. Both the 401k and the IRA also have the potential option of being a ROTH account as well. The label of a ROTH account refers to how the account will be taxed by the IRS.

In a ROTH 401k or ROTH IRA your contributions to the account will be taxed up front and the remainder will be put into the account . Once you are of age to withdraw the funds, your contributions and growth in the account are generally considered completely tax free. ROTH accounts are particularly beneficial for individuals who believe that their current tax rate is lower than what their future tax rate will be when they withdraw from their retirement account.

Non-RetirementAccounts

If you’d prefer access to your money in the short term, a non-retirement account is for you. There are several different investment account types for a non-retirement, or brokerage, account. You can hold a brokerage account as an individual or register yourself and one or more people as a joint account.

Taxation on Non-Retirement Accounts

Taxation for non-retirement accounts is simple. You are only taxed on the gains in your account once a position has been sold at a profit, or if you receive dividends. Even if you decide to reinvest your dividends, you will still be taxed for receiving them. If you hold your investments longer than 12 months, then you may be eligible for capital gains. Capital gains provides a reduced tax rate on your investment gain. Some dividends may also be qualified dividends which allows for a reduced tax rate on your dividends.

Types of brokers

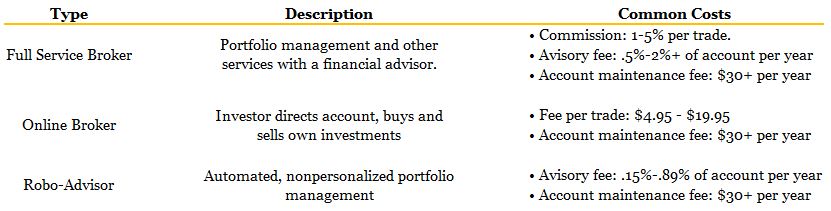

Now that you know what type of account to open, it’s time to choose a brokerage firm. Choosing a firm to open a brokerage account with involves many questions. In general, there are three types you can choose from: full service broker, online broker and robo-advisor.

If you subscribe to Hedgehog Investment Research, you are most likely interested in utilizing an Online Broker to transact your trades. Brokerage firms like Charles Schwab, Robinhood and TD Ameritrade tend to have the lowest trade cost if you are a fee conscious investor. See our short guide for the fee conscious investor. Online brokers may have different trading costs, incentives, services and account minimums that should be researched further before a final decision is made.

Once you find an acceptable brokerage firm it’s time to apply to open an account. After the joys of paperwork have swept through your life, you’re finally ready to choose what investments go into your account! How Do I Start Investing: Part 2 is available for you to learn what to invest in and how to decide on your investment strategy.