How Do I Start Investing? – Part 2: Active vs. Passive Investing

If you are new to investing, you’ll need to know what type of account to open, who to hold your account with, what to invest in and how to decide on your investments. This article is the second part of a two-part series that aims to answer those questions, active vs. passive investing and more.

Learn which investment account types might be best for you in the first part of “How Do I Start Investing?”.

What Investment Account Types are Available for Me?

Active vs. Passive Investing

Broadly speaking, there are two methods of investment portfolio management. We will take a look at active vs. passive investing. Actively managing an account involves attempting to take advantage of short-term price fluctuations with the goal of outperform a given benchmark; often the market (S&P 500). Active portfolio management often requires detailed analysis of individual stocks, ETFs or bonds. Unfortunately, the vast majority of active managers fail to beat the S&P 500’s performance year after year. However, if you are interested in stock picking, then this is the strategy for you. Go for individual stocks and try to orient yourself as either a growth or value investor.

Passive investing has become quite popular in the last few years. Financial professionals’ underperformance and the low cost of new investable ETFs has led many investors to take matters into their own hands. Passive investing entails limiting the purchases and sales in your portfolio in order to invest for the long haul. These strategies eliminate, or greatly reduce fees relating to investment advice, trading costs, short term taxable gains and portfolio turnover.

Passive investors often choose indexed ETFs, such as SPY or AGG, in order to keep pace with the market. Limitations to this strategy are the same as with active investing. Since indexed funds track their benchmarks, it is not within the nature of the investment to “beat” that benchmark. If this sounds like you, consider taking a look at those indexed ETFs listed above, as well as others, for the funds that most closely resemble your investment interests.

How to Decide Your Investments

Hopefully by now you know whether you are ready to actively, or passively, manage your investment account. Although we at Hedgehog Investment Research provide focused guidance in passive investment portfolio management, our models help both active and passive managers to make smarter, more timely decisions. Following these basic principles of investing should provide a guideline for your ultimate investing style.

Investment Principle #1: Be Invested

This one seems like a gimme. But hear us out! Investors often get so wrapped up in waiting for the right time to buy that they end up watching their stock(s) run away from them. It’s prudent to remember that over large periods of time, the market tends to go up. Unless your prospective investment’s time horizon is short, or has high valuation ratios, your purchase does not require pin point precision in timing.

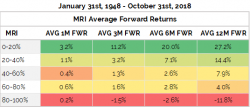

There are periods of time where the overall market holds a high amount of risk. Lucky for you, our Market Risk Index (MRI) provides a reading of 0 to 100 showing the relative risk in U.S. stocks since 1948.

The table above shows that on average you can expect positive returns for S&P 500 while the MRI is within any range below 80-100. This level of high systematic risk shows times of relative distress in the U.S. economy and is likely to be shown in the market. Unless we see high levels of systematic risk, there is little need to wait on the sidelines. Don’t let the emotions of fear and greed control your investment decisions.

Principle #2: Be Disciplined

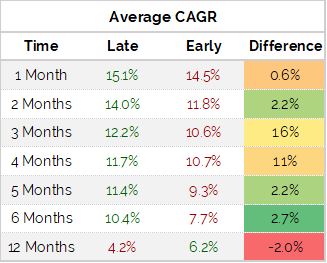

It may help to know that it is better to be continuously late rather than continuously early when investing in the broad market. As stated in Principle #1, the broad market tends to go up over large periods of time. Therefore, subjecting yourself to the emotions of fear and greed in investing will only serve to diminish your returns. An investor should only sell when they are as certain as possible that a significant decline is likely to occur. A good example of this principle is shown in the image below.

This table shows the annualized rate of return you would have enjoyed had you bought and sold “X” months before or after major market peaks and troughs. You can see that our late column outperforms our early column in every iteration besides the 12-month scenario. This shows that you can be 6 months, or later, in selling after market tops and buying after market bottoms, and still be better off than those who solidify their convictions before the market’s path is certain. Want to know when to buy and sell your stocks and bonds? See our bread and butter: Stock Bond Rotation Model (SBRM).

Principle #3: Avoid Large Losses

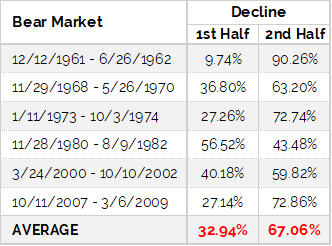

Although we prefer to be late rather than early, it is still important to mitigate the potential risks to your portfolio. Since 1960, more than two-thirds of a bear market’s price decline has come in the second half of that bear market’s life (see table below). Further giving respect to the fact that an investor can still outperform the market without trying to time the market.

Massive losses can set back a portfolio back for years. Consider a portfolio of $100 that can either gain, or lose, $50. A $50 loss would leave an investor requiring a 100% gain in order to come back to their initial investment of $100. On the other hand, an investor that gains $50 now only needs a 33% decline in order to reach their initial investment value. This principle is also illustrated in a concept known as sequence of returns risk. This concept suggests that the worst time to experience a large loss is at the beginning or the end of an investors holding period. Our Equity Warning Signal (EWS) gives investors warning that significant market volatility may be ahead. Investors subscribing to the EWS model would have lost -7.32% in the 2008 financial crisis.

Learn How Financial Investment Models Will Help You Get Started

Throughout this two-part composition we have led you from start to finish on how you can start investing. By now you should understand what type of investment account is right for you, what brokerage firm to choose, active vs. passive investing styles and the major investment principles that can lead to more intelligent investment decisions. If there is anything we did not cover that you have questions about, contact us!