Buyer Beware: S&P 500 Sold as Is

Our current market decline has occasionally left us feeling like our bull market may be on the edge of kicking the bucket. Since the peak of the S&P 500 on September 20th, we’ve endured a 19.78 percent decline at our worst. The market route has been relatively destructive, but things seem to be looking up as the market has risen nearly 10 percent since then. Where does this leave us? Is the worst in the past? If history is to be of any guide, it may be too early to tell.

Post 1950, the S&P 500 has endured 16 retreats of 12 percent or more during bull markets, with the stipulation that these retreats never hit a decline of 20 percent or greater. The average of these declines stands at a meager 15.7 percent when compared to our present situation. Typically, the time spent in these corrections is nearly six months on average according to our research at Hedgehog Investment Research. In other words, it takes the market nearly half of a year to decide to move back into positive territory. The quickest recovery on record took 32 days, starting October of 1999 and was the beginning of what would eventually become the blow off top to the tech bubble. In fact, the research suggests, the faster the recovery, the more likely the current market regime is to change. In every case of the 16 retreats where recovery took less than three months, the previous bull or bear market reign was terminated. This doesn’t exactly spell good news for our 3,597 day old bull market.

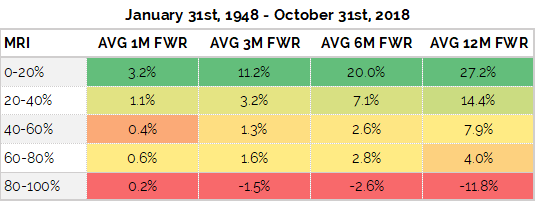

Our proprietary Market Risk Index hit a level of 89.37 percent out of a possible 100 this past December; indicating that business cycle conditions are well on their way to overheating, if not already in dangerous territory. Average 12 month forward returns for the S&P 500 when the Market Risk Index is between 80-100 are -11.8 percent. Unfortunately, this does little to give us hope about further longevity in our dearest bull market.

While we seem to have exceeded the average drop in equity prices for these types of situations, time seems to be a limiting factor for us if we are to recover from this sting. We’re seeing more and more green in the S&P 500 as holiday cheer turned into holiday spending. Meanwhile, Trump is increasingly eager to lay trade talks to rest with China and every check up with the Fed shows an increasingly dovish policy. All good news. The last worry on investor’s checkbox: How significant will the decline in earnings be for companies during 2019? How much will companies’ bottom lines be impacted by the apparently impending global slowdown? These questions may be the unresolved catalyst disallowing the market to further take off. Until we get clarity and answers, we are more likely to follow the average half-year route back to the levels we saw in September. Unsurprisingly, this puts us in the same time frame that first quarter earnings of 2019 should be released. It seems our engrossing questions will be met with rather timely answers after all.

Check out our Principles of Investing to learn more about our process.